Where Data Tells the Story

© Voronoi 2026. All rights reserved.

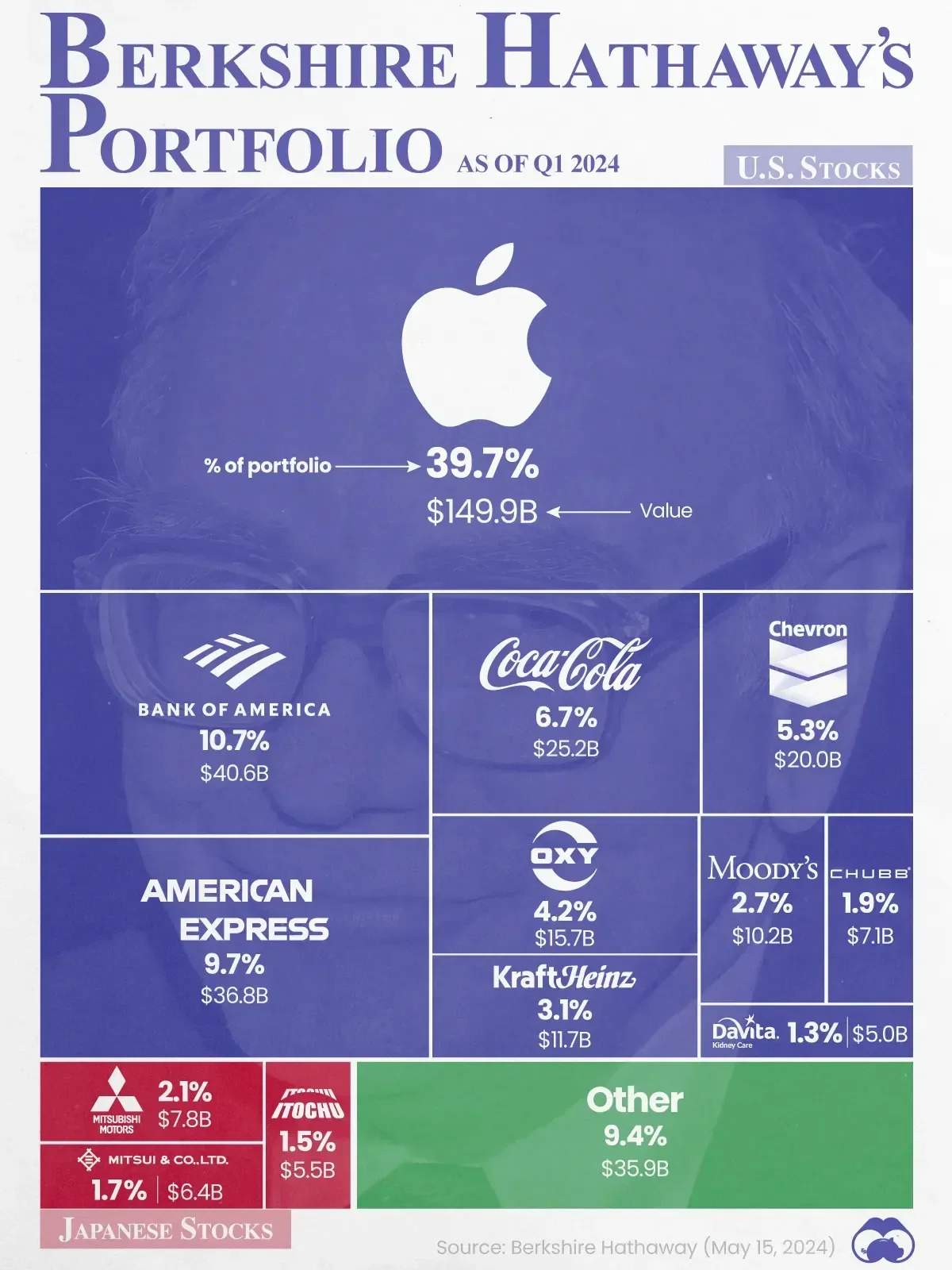

This graphic illustrates Berkshire Hathaway’s stock portfolio, as of March 31, 2024 (released on May 15, 2024). This data can be easily accessed via CNBC’s Berkshire Hathaway Portfolio Tracker.

Note that Berkshire has received SEC permission to temporarily withhold data on certain holdings. This includes all of its Japanese stocks, which are reported as of June 12, 2023.

By far, Berkshire’s largest position is Apple, making up almost 40% of its portfolio and worth nearly $150B. This position is so large, it represents a 5.1% ownership stake of Apple.

In 2020, Berkshire took positions in five Japanese trading houses: Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo. Also known as sōgō shōsha, which translates to “general trading company”, these firms are highly diversified across major industries.

According to an article from IMD, Buffett sees an attractive opportunity in Japan due to the country’s low-interest rates, among other things.