Where Data Tells the Story

© Voronoi 2025. All rights reserved.

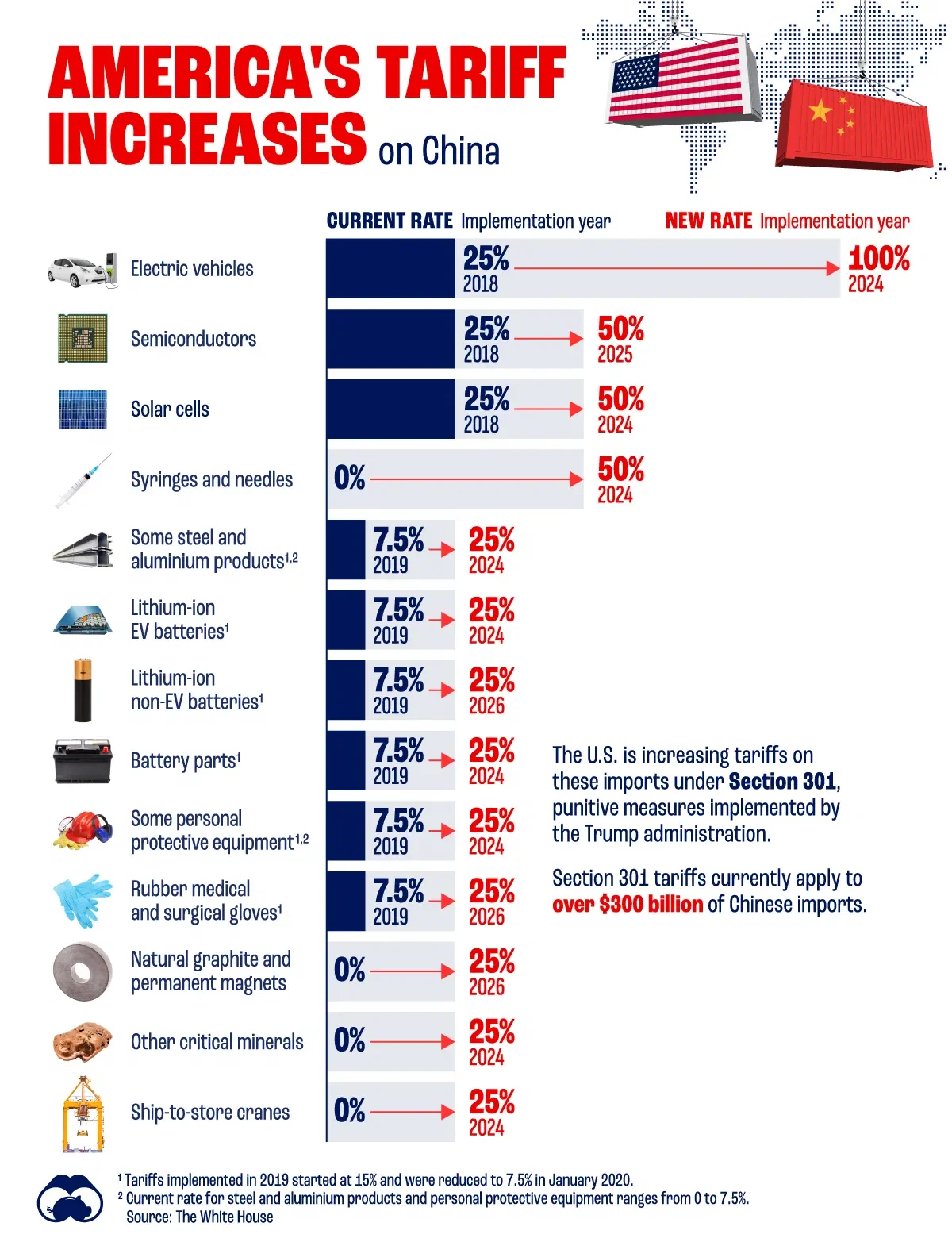

The new and current U.S. tariff rates set on a variety of Chinese imports under Section 301, a provision that allows the U.S. government to investigate and respond to unfair trade practices by foreign countries.

Tariff rates and implementation years for the new rates come from The White House’s May 14 press release announcing tariff rate hikes.

Implementation years for the current rates comes from the Office of the United States Trade Representative and United States International Trade Commission.

Tariffs are taxes imposed by a country on imported goods to protect domestic industries, regulate trade, or generate government revenue.

The U.S. hiked up tariff rates for a range of Chinese imports in the EV industry, including semiconductors, lithium-ion batteries, and other battery parts. Notably, tariffs on electric vehicles were also bumped to 100%.

The U.S. also introduced new tariffs on certain critical minerals, which are integral to manufacturing battery parts and semiconductors.

Current tariff rates for steel and aluminum products, as well as personal protective equipment (PPE), range from 0 to 7.5%.

Tariffs in this infographic that were implemented in 2019 were initially set at 15% and later halved to 7.5% in January 2020.