Where Data Tells the Story

© Voronoi 2025. All rights reserved.

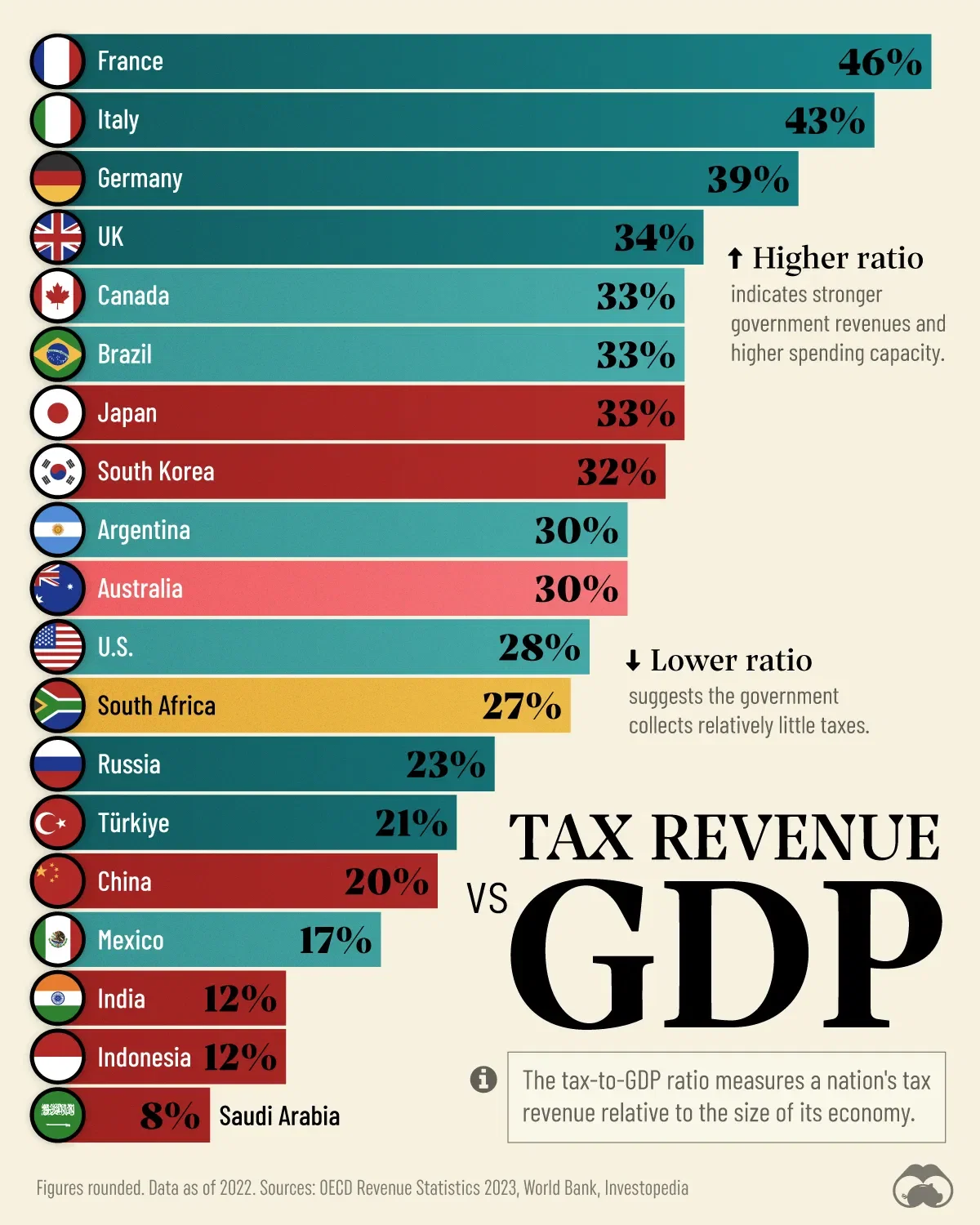

A chart ranking major economies by their tax-to-GDP ratios, as sourced from OECD Revenue Statistics 2023.

The tax-to-GDP ratio is a financial snapshot that shows how much a government collects in taxes compared to the total value of all goods and services produced in a country (GDP). It's like measuring how much money a household spends on rent compared to its total income. A higher ratio generally means the government collects a larger portion of the economy's output through taxes.