Where Data Tells the Story

© Voronoi 2026. All rights reserved.

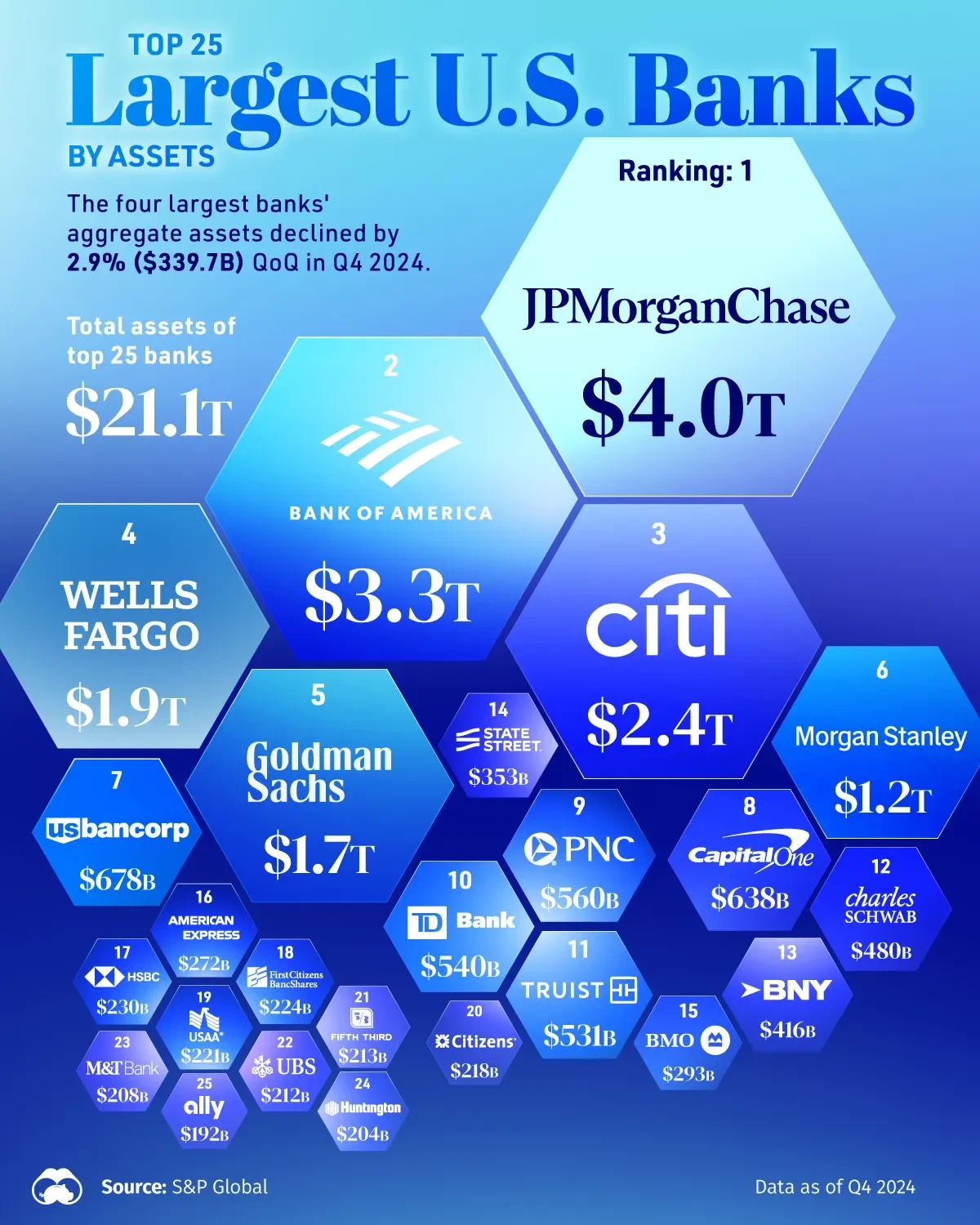

This infographic highlights the 25 largest U.S. banks by total assets as of Q4 2024. Assets include cash, loans, investments in securities, and various other assets like properties.

The data comes from S&P Global Market Intelligence and is based on regulatory filings as of December 31, 2024.

U.S. banks saw asset fluctuations in 2024 amid a relatively high interest rate environment and geopolitical uncertainties, although domestic GDP growth outperformed expectations.

Multiple factors were at play behind the shrinking bank balance sheets in Q4 2024, including tighter monetary policy, weaker loan demand due to high borrowing costs, and an overall slowdown in credit expansion by banks.

However, according to S&P Global Market Intelligence, bank executives expect an increase in deposit and loan growth in 2025, which could help drive asset expansion over the year.